Here are some things I think I am thinking about over the weekend:

1) WAR!

The situation in the Middle East is getting more and more uncertain as Iran and Israel trade barbs. I guess that’s an evergreen statement for the Middle East, but this situation does have a different feel given the Ukraine war and the situation in Taiwan. I could easily see a scenario where things get worse in Iran/Israel and the US gets dragged into it all. And then when you’ve got wars in Europe and the Middle East the Chinese might feel left out and decide they want to join the party and test how wide the Americans want to spread themselves militarily. That’s a worst case scenario obviously, but one that appears more and more probable as the years go by. Heck, we don’t even need China to do anything before the situation in the Middle East gets very ugly.

Now, I am not remotely close to being a military strategist, but as a risk manager I think it would be naive to assume these events are non-events just because they’re not on American shores. After all, major oil supply disruptions will impact the entire global economy. And a war in Taiwan would disrupt the entire global supply chain so these risks are worth analyzing especially given the inflation saga we’ve all been dealing with. Add in an already fragile global economy and who knows where this all leads?

I don’t have a strong directional bias about specific outcomes but I think events like this are a good reminder that it’s prudent to have portfolio insurance. In the Defined Duration strategy insurance includes things like gold, managed futures and options hedging. These instruments operate like super long duration assets that can provide highly asymmetric short-term returns that insure against things like economic and stock market risk. But I also think you can utilize cash and TBills as a form of insurance when real rates are as high as they are so that’s another good option for people who are skittish about owning gold, futures and options. But the broader point is that one big lesson from Covid is that risk is things we can’t predict and any investor who needs certainty in the coming year (or years) can benefit from owning appropriate amounts of insurance in their portfolio so that their portfolio isn’t being whipped around by the frantic reactions of the S&P 500. In other words, insurance is useful in a portfolio because it can help us remain calm when everything around us is uncalm. And yes, it will often be a net drag on the portfolio (especially during stable times), but that’s what insurance is – it’s a negative yielding long-term instrument that can provide potential stability during very uncertain times.

2) Why Does the Fed use Core Inflation?

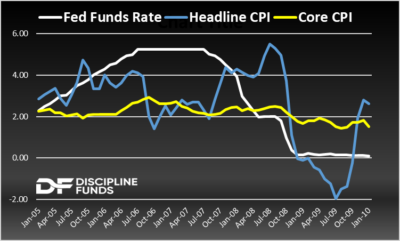

This is a question I get regularly. It’s easy to mock inflation metrics like core inflation which remove food and energy. After all, it seems kind of silly to remove essential items like food or gasoline. But the problem with these items is that they can be very volatile because they’re so directly tied to commodity price swings. The Fed prefers to use inflation metrics that remove them because it creates a more stable understanding of trend inflation rates. It’s very common in statistical analysis to throw out the outlier variables that might be adding excess variance.

A good example of why this often makes sense is to study a very volatile period like 2008. In 2008 the banking crisis was just starting to unravel and the economy was looking increasingly fragile. And as we entered the Summer time oil prices skyrocketed higher. The bled thru to headline CPI and caused a very large spike to well over 5%. It was a weird time for the Fed because they’d been tight for a bunch of years at 5% and then things started to slow pretty materially. They were cutting rates even as headline CPI was surging. And one of the main reasons for this is because core CPI wasn’t trending aggressively higher. The Fed took a brief pause from cutting during that oil shock, but didn’t fall for the head fake we saw in headline CPI in large part because core CPI was telling a very different story. And we all know what happened next – the largest deflationary event of our lifetimes. And if the Fed had been relying on this very volatile headline figure it’s likely that they’d have raised rates into that oil rally and exacerbated all the problems that were developing under the surface.

In short, core CPI is useful because it gives us a little better understanding of trend inflation because it strips out some of these very volatile instruments that could mislead us about where inflation is trending.

3) Macro Dashboard.

Check out our macro dashboard if you’d like. I’ve started adding a bunch of useful indicators and metrics that I use to analyze the macroeconomy. In the coming year I’ll hopefully add some financial planning calculators and other portfolio analysis metrics. This will hopefully become a sort of one-stop-shop for getting a quick and updated snapshot of the economy as well as some indicators that I like to use to measure things like recession risk. You can find it in the top toolbar of the site under the “News and Updates” tab. I hope you find it valuable.

NB – We got some new baby chicks and I have to say that in addition to hedging the surging price of eggs this was one of the first times where I’ve started to feel normal after the death of my dog over a year ago. I’m not ready to jump back in and get a new dog, but it sure is a lot of fun having some new chicks around and seeing how much the girls adore them.

I hope you have a wonderful weekend.