Countercyclical Indexing FAQ

Traditional multi-asset (stock/bond) index funds have a fixed weighting of something like 60% stocks and 40% bonds. This rebalancing methodology can be problematic because it deviates substantially from the actual underlying market capitalization and always rebalances back to 60% equities, which contribute over 85% of the risk in the portfolio over time. This leads to an unbalanced risk exposure that becomes exaggerated when the stock market booms.

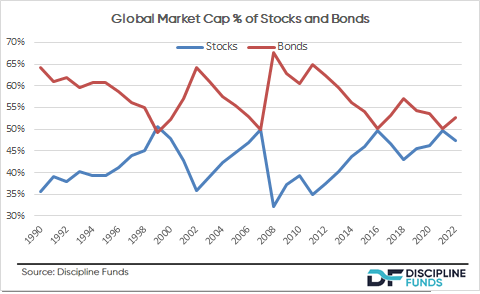

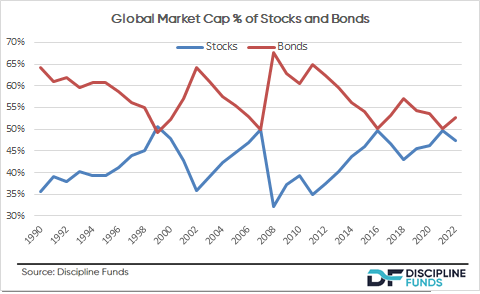

While a fixed weighting creates a simple rebalancing strategy there is very little sense in rebalancing back to a fixed weighting in a multi-asset portfolio because the underlying market caps are so dynamic. For instance, a true "passive" multi-asset index  fund should have a dynamic relative weighting between stocks and bonds since the actual market caps change so much from year to year. But most multi-asset indexing methodologies apply a fixed weighting in their stock/bond weights and always rebalance back to this weight regardless of how the actual underlying market caps change. This means you're always rebalancing back to a higher stock market weighting when the stock market booms thereby resulting in the potential for excessive stock market risk at the worst possible times. This makes no sense! Countercyclical Indexing solves this problem by applying a tax and fee efficient indexing methodology that removes some of the procyclical tendencies from traditional rebalancing methodologies thereby better aligning a portfolio's asset allocation with the way we actually perceive risk.

Read our white paper on Countercyclical Indexing here.

fund should have a dynamic relative weighting between stocks and bonds since the actual market caps change so much from year to year. But most multi-asset indexing methodologies apply a fixed weighting in their stock/bond weights and always rebalance back to this weight regardless of how the actual underlying market caps change. This means you're always rebalancing back to a higher stock market weighting when the stock market booms thereby resulting in the potential for excessive stock market risk at the worst possible times. This makes no sense! Countercyclical Indexing solves this problem by applying a tax and fee efficient indexing methodology that removes some of the procyclical tendencies from traditional rebalancing methodologies thereby better aligning a portfolio's asset allocation with the way we actually perceive risk.

Read our white paper on Countercyclical Indexing here.

fund should have a dynamic relative weighting between stocks and bonds since the actual market caps change so much from year to year. But most multi-asset indexing methodologies apply a fixed weighting in their stock/bond weights and always rebalance back to this weight regardless of how the actual underlying market caps change. This means you're always rebalancing back to a higher stock market weighting when the stock market booms thereby resulting in the potential for excessive stock market risk at the worst possible times. This makes no sense! Countercyclical Indexing solves this problem by applying a tax and fee efficient indexing methodology that removes some of the procyclical tendencies from traditional rebalancing methodologies thereby better aligning a portfolio's asset allocation with the way we actually perceive risk.

Read our white paper on Countercyclical Indexing here.

fund should have a dynamic relative weighting between stocks and bonds since the actual market caps change so much from year to year. But most multi-asset indexing methodologies apply a fixed weighting in their stock/bond weights and always rebalance back to this weight regardless of how the actual underlying market caps change. This means you're always rebalancing back to a higher stock market weighting when the stock market booms thereby resulting in the potential for excessive stock market risk at the worst possible times. This makes no sense! Countercyclical Indexing solves this problem by applying a tax and fee efficient indexing methodology that removes some of the procyclical tendencies from traditional rebalancing methodologies thereby better aligning a portfolio's asset allocation with the way we actually perceive risk.

Read our white paper on Countercyclical Indexing here.

This can vary greatly depending on how the customized portfolio is constructed for you. But in general, we don't believe in the Wall Street mantra of trying to beat the market and get rich quick concepts.

The investment management business has mastered the art of selling high fees in exchange for the hope of high returns. But unfortunately, high fees in no way guarantee high performance. And ultimately, this financial model can lead to a portfolio manager taking additional risk to try to “beat the market.” This creates behavioral risk for the shareholders since they may be subject to big swings in their savings due to this increased risk.

We believe investors deserve a more honest approach to performance. Most investors shouldn't try to beat the market and probably have no need to. Instead, they should focus on reallocating their savings in a manner that is aligned with their personal financial goals and behavioral constraints. This means investing in the appropriate portfolio rather than the illusory perfect market-beating portfolio.

The Countercyclical Indexing and Defined Duration strategies are not "beat the market" strategies. They are strategies that are specifically structured to align with your financial goals and help you behave better. This will not only increase the odds of achieving your financial goals, but it will also help you sleep better and focus on the things that are most important in life.

We generally recommend a Countercyclical Indexing strategy within the Defined Duration strategy as it meets the "duration" of approximately 10 years. This helps it operate within a broader asset allocation strategy as a moderate duration core holding. This also functions as a very tax efficient and diverse holding that we can then construct satellite positions around to meet other financial needs. We offer this strategy through an ETF as well as separately managed accounts. Contact us for more details.