Okay, it’s one thing inside of three things, but they’re also three kind of different things related to one broader thing. I might be overthinking this.

1) The Labor Market is Very Soft. But Why?

One of the recurring themes here over the last year is that the labor market has been soft. A lot of leading indicators in the labor market have been weirdly weak despite headline figures that kept coming in above expectations. I’ve noted, on numerous occasions, that the labor market was vindicating the Fed’s rate cuts during the last year. But then the data got all sticky earlier this year, beat expectations consistently and yet the underlying leading metrics were still pretty soft. It was. Weird. And I have to admit that I felt like I was missing something at times.

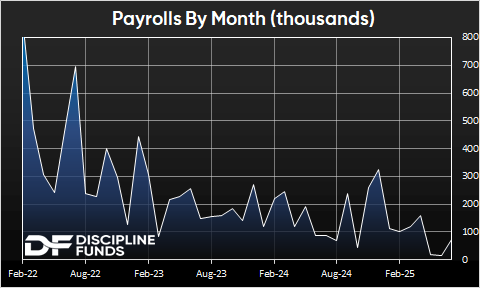

But then today we got the biggest revisions in 50 years and they showed that the headline figures had been overstated by a pretty significant amount. And in fact, all this time the labor market has been soft. Just like the underlying leading metrics were saying. The May and June reports were revised down a whopping 258K jobs to just 14K and 19K. And as we can see in the accompanying chart, the trend is not great. But why? Why is the labor market so soft? I think there’s three things going on here because who doesn’t love three things inside of three things?

First, you have the tariffs. It’s no coincidence that the softest hiring of the last few years occurred right when the tariff scare started. We got a ton of private sector commentary and data confirming that the uncertainty was halting new hiring and investment. That is, in part, why the tariffs were never implemented in the hugely devastating amounts that were advertised in April. Remember when the CEOs of Walmart, Target and Home Depot went to the White House and then we magically had a deal with China within a week? Yeah, they told the White House how bad this idea was and the embargo with China immediately ended. But the damage had been done and now it’s showing up in the data. And even though the actual implementation of tariffs has been relatively small that uncertainty was enough to slow hiring some. Thankfully, this month started to show some pick-up as the uncertainty has waned.

Second, I have to to wonder if AI isn’t starting to show up here. This is another theme I’ve been discussing at times. There’s a real chance that we’re undergoing a seismic shift in how we all work and that AI is either going to replace a lot of work or reduce the need to hire people to do a lot of that work. The thing that’s worrisome about this labor report is that outside of healthcare the private sector isn’t hiring and is actually shrinking for the last three months. We would have lost 53K jobs in May and 45K in June were it not for healthcare. So the private sector has really pulled back and it’s hard for me to believe that some of this isn’t being driven by expectations that AI is about to replace a lot of work. And if that’s becoming a trend then this is an economy whose direction is very, very hard to predict because the paradox of AI is that it makes the economy more efficient and productive, but it could come with enormous inequality which reduces employment and aggregate demand while making a small number of people and firms very wealthy.

Third, I still think a lot of things are mean reverting to the pre-Covid era. For instance, wages are growing at 3.9% which is the top end of the 40 year range. What has materially changed about the world that would warrant a new normal in wages? I can’t tell you. In fact, I’d be willing to bet both of my daughters that we settle somewhere in the 3-3.5% range in the coming years. And my daughters are super, duper cute and I would fight anyone on this planet for them. So that’s how confident I am about this. But there’s a slew of other data that is still trending lower, but elevated from the Covid boom. It’s all still in the process of slowing and I don’t think that process is done just yet.

Anyhow, none of this is the end of the world. It’s not great. But the softness in employment is finally clear and it’s hard to see a labor market boom materializing any time soon.

2) The Labor Market is Manipulated. Or is it?

Any time we get big revisions like this there are immediate cries of manipulation. There’s a lot going on with BLS employment reports and there’s a lot that can go wrong, but they’re not manipulated and we know they’re not manipulated because the process doesn’t allow for it. So let me clarify some of the confusion because these narratives seem to be promoted by people who don’t understand how this works.

The government collects labor market data through state employment records. 95% of all US wage and salary jobs are compiled by the states and compiled in what’s called the Quarterly Census of Employment and Wages (QCEW). And although this data is very accurate it is also very laggy because firms have 90 days to submit the data, states must compile it and then the BLS must validate all the submissions. This generally results in a 5-8 month lag in accurate reporting. The BLS realized that this was no bueno for policy purposes and that you needed a more real-time measure. So they do the monthly employment surveys to try to obtain more real-time data. This is far less accurate, but it gives us a directional sense of where the QCEW might end up. And over time the BLS matches the QCEW data with the monthly data and it ultimately ends up being very, very accurate. But in the short-term there is a lot of noise because surveys are inherently imprecise.

There’s also a problem here where the BLS has consistently expressed that budget reductions and reduced survey responses have made the data less reliable with time. Not to mention the federal hiring freeze compounded all of that in recent months. So the monthly data collection process has become less reliable over time which has created a growing gap between the short-term reliability of the monthly surveys relative to the very reliable long-term data in the QCEW. And that’s why we have revisions like we did on Friday. Joe Weisenthal and Tracy Alloway did a wonderful podcast with the former Commissioner of the BLS on this topic a few months back (listen here). It’s a great inside look into why the monthly data accuracy is deteriorating. The BLS is incredibly transparent about all of this so it’s not like they’re out here hiding things from everyone. They will tell you themselves that their own process is inefficient and needs upgrades (and a bigger budget).

But make no mistake – the data isn’t manipulated. It cannot be manipulated. It would take a coordinated effort by all 50 states to manipulate the QCEW and that’s implausible. The monthly data might be noisy and unreliable, but revisions do not reflect manipulation or inaccuracy. The revisions actually bring us closer and closer to the QCEW data, which we know is right. So Friday’s employment report and its big revisions are telling us the truth about what’s going on in the labor market.

And besides, this report has been broadly confirmed by other labor reports. ADP, Challenger, Indeed and ISM have all been reporting softness in employment for a while now. It was the stronger BLS figures that were the outlier this whole time. If anything, recent data was manipulated HIGHER and now we’re starting to see the truth come out as revisions bring everything in-line with the real arbiter of employment truth, the QCEW. So, no need for conspiracy talk. And we certainly shouldn’t go so far as to consider firing people like the head of the BLS over monthly data. That would be nuts.

3) The Labor Market Means…Rate Cuts are Back.

The bottom line from Friday’s labor market bombshell was that rate cuts become the more obvious outcome in future FOMC meetings. It’s interesting to look back at just Wednesday and how seemingly hawkish Jerome Powell was. He sure wishes he’d seen this report before that meeting. But I still don’t think we can jump to a strong conclusion here. The Fed’s at 4.33% and Core PCE is hovering ever closer to 3%.

I am still on the fence here about the direction. The labor market is soft, but it’s not collapsing. And inflation is still too high to justify aggressive cuts. So I wouldn’t be surprised if they err on the side of caution and remain highly data dependent. If we see material weakness in unemployment claims and the next few employment reports then we probably get a cut at the October and/or December meetings, but I don’t think this employment report makes the September meeting a slam dunk cut. We’ll have to wait and see how the next few months of data play out and hopefully we get a clearer sense of direction.

Well, that was probably more than you wanted to hear from me. I hope you have a wonderful weekend and as always, stay disciplined.