Here are some things I think I am thinking about this week.

1) More on Exponential AI.

Boy. I got a lot of feedback from last week’s commentary on exponential AI. But I feel like it’s already accelerating, at least for me personally….

I’ve always been somewhat tech savvy, but I’ve never been close to a software engineer. I understand HTML and can write enough code to do web design and things like that, but it’s all pretty basic as far as I am concerned. But that all changed in the last month and has accelerated in the last week. I spent a lot of the last week implementing and producing software inside of financial products. MY OWN SOFTWARE PRODUCTS. It’s the most exciting thing I’ve done in a long time. I have a billion Excel files and “calculators” that I’ve developed internally over the last few decades that I keep private mostly because I never knew how to turn them into user facing software. Well, that’s all about to change. AI has now given me the ability to take every concept, calculator, and piece of knowledge I have in a spreadsheet and turn it into actual usable software. And I can personally build 100% of it using my custom knowledge base leveraged through AI. It’s a crazy experience. I feel like I suddenly learned Chinese and now the entire Chinese economy is open for me to work with. This is a game changer for my business, but I can only assume that millions of other business owners are going thru some sort of similar experience.

I’m going to be rolling out some very cool real-world financial tools in the coming year. This is especially cool in the asset-liability matching world where there’s virtually no tools for advisors and retail investors since it’s mostly used by pension funds and banks. As you probably know, I’ve become a big advocate of what’s called liability driven asset management. That is, you start with the financial plan and liability assessment and then you fill in the asset management blanks after the fact. In retrospect, I think my old process was imprecise at best. I’d profile someone, run a financial plan and then slap together an asset allocation for them trying to optimize the assets instead of optimizing how the liabilities relate to the assets. I understood why the old process might work, but the client barely did because the whole process is based on vague inputs/outputs and focuses on the assets and their performance as opposed to giving the client context about how their asset relate to their liabilities. The liability driven process changes that entirely and creates a purely systematic and quant based financial assessment that allows you to then match liabilities with assets in a super clean package that the client actually understands and can tangibly see how it matches with their financial plan. In this process the client can actually understand how their assets are supporting a specific part of their personal balance sheet and ability to spend over time. And the best part is you don’t even have to worry about behavior because the process systematically resolves the behavioral side by structuring the asset allocation so the liability worries are embedded in the output. No more silly questions like “how do you respond to a 30% decline in stocks” because the structure of the allocation solves for that by creating specific temporal buffers in the output. In other words, you automatically solve for behavior because the process inherently protects clients from short-term worries.

Anyhow, I am working on the software to roll this out in a nice clean package so we can bring this sort of process to advisors and retail DIY investors. I’m having some fun with it and I think you’ll find it really helpful. But boy, the AI stuff is moving fast. Really fast.

2) More Employment Cracks?

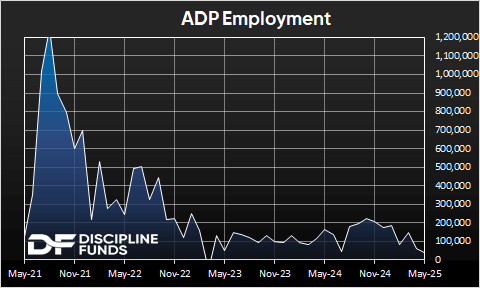

This Friday’s employment report is going to be one of the more interesting ones in a long time. We’ve had a slight uptick in jobless claims in recent months and then Wednesday’s ADP report was a stinker with just 35K jobs. Over the last 6 months the ADP employment trend has been pretty much straight down.

This all matters because it’s likely to be THE determining factor for future interest rates. The way I view all of this right now is that the Fed isn’t going to be swayed by the next few inflation reports. They’re too noisy with the tariff data lagging in and all the weird stuff that happened in April. So they’re much more focused on the labor market. And if we start to see the tariff softening show up as labor market weakness then they’re going to reposition to a more rate cutting accommodative position since they view the tariff price changes as likely to be “transitory”.

The labor market has been incredibly resilient so far. Let’s see if it lasts.

3) The Myth of F$ck You Money.

Sorry for the language. I grew up at a farm school with a Marine for a father so I didn’t learn language etiquette. Sorry, not sorry.

Someone on Twitter asked what is the level of “f$ck you” money? That’s the amount of money where you can literally tell your boss or the rest of the economy to eff off. As I get older I increasingly don’t believe this is a thing.

A funny thing happens as you get older, make some money and have kids – the treadmill of life gets harder to grip. The money makes life easier, but the kids make everything more uncertain and then there’s the fun topic of mortality, which obviously makes everything uncertain (or very certain at some point). But I’ve noticed an interesting thing over the course of time as I’ve gotten wealthier and seen some other people get enormously wealthy – they never reach the point of “f$ck you”. Or, I guess we can assess this in two different ways. There are the jerks who actually get to a point of EFF you. But for those people the money just exposed who they always were. Then there are the people who get rich and don’t change. Or just get a little more generous with what they have. They never feel the need to tell anyone to EFF off because the money didn’t change them. I always like to say that money doesn’t change who you are, but it can expose who you really are. Jerks will tell everyone to EFF off when they get rich because they were always jerks and now the money gives them the power to stop caring. They never really cared before, but they had to behave well because they couldn’t afford to piss everyone off. You see it on Twitter all the time – literal billionaires acting like jerks because they can afford to act like jerks. They think they’ve reached a position of f$ck you, but in reality they were already f$cked. The money just gave them the confidence to show it off to the world.

But in a broader sense, I don’t even think there’s a point where anyone can tell the system to f$ck off. Sure, there are levels of money that make life much easier. But I’ve seen people who made $100MM in a year and they don’t know what to do. They certainly don’t tell the whole world to piss off. They take breaks, work less, but they always come back to the system or remain entrapped in it in various ways. Did they find “enough”? Maybe. But then the system lures you back in and makes you think you need more or you just get hungry for purpose again. The problem is that “enough” is a moving target that changes with inflation, kids, multi-generational needs and lifestyle creep. I used to think the concept of “enough” was simple. It actually was before I had kids. But as I’ve gotten older I’ve realized it’s a moving target that you can never quite pin down. I don’t know what enough is now because I want to provide something for my kids, but I have no idea what the world will look like when I am gone. I have no idea what “enough” will be for them so I find myself stuck to the treadmill because I feel a deep responsibility to them (and to everyone I work with) to keep moving forward. I honestly don’t know what “enough” would even be at this point.

Don’t get me wrong. I think there’s a balance here. I think there’s a point where you make enough money that life becomes much easier and you get to relax a bit more. But even the richest people in the world are still going after it almost every single day. Just look at Buffett, Gates, Bezos and Musk. Maybe they’re not as hungry as they once were, but they’re still on that treadmill running the race with the rest of us. The thing is, they never reached a level of “f$ck you” because they realized there isn’t a finish line to this race and that it doesn’t even really stop when you’re put in the ground. It keeps going, you’re not a participant anymore, but you can impact the race even when you’re gone. And there’s a certain beauty in that. There’s a comfort in knowing that you can keep charging thru life, trying to be productive and knowing that financial freedom isn’t a finish line, but a journey where you become increasingly independent, but still intertwined in an exciting race to help other people, have a purpose AND hopefully find enough balance in there to not turn into a jerk in the process.

Anyhow, I don’t know where I am going with all that, but it’s something I think about a lot these days as I assess my impact on the race that we’re all running. Don’t worry, I am a really slow runner so I’ll make sure not to bump into you, but if I do I’ll be certain to say “excuse me” because I certainly learned that one from my Marine father.

I hope you’re having a wonderful week. As always, stay disciplined.