One of the most common questions we get is “should I be worried about the death of the US Dollar?” It’s a worthwhile question and certainly not a zero probability event. In fact, as Keynes famously said, “in the long-run we are all dead” and so are all fiat currencies. IN THE LONG RUN. Yes, it’s true, all fiat currencies die in the long-run and the USD isn’t going to be an exception. But how relevant is this risk in our lifetimes and should we (or how should we) protect against it? Let’s look into this topic more closely.

One thing I’ve written about frequently in the past is that currency devaluation and living standards are not the same thing. For instance, the US Dollar has lost 96.8% of its purchasing power since 1913. This sounds alarming, but US living standards have boomed since then. An American living in 2024 lives a substantially better lifestyle than an American in 1913 (see this piece for more data on this). This is because GDP, wages and real asset values have far exceeded the loss in purchasing power. For instance:

- Household net worth in the USA is the highest in the world.

- US Real GDP is the highest in the world.

- US Median Real Income ranks 5th in the world.

- The median income earner in the USA is in the top 1% of global earners.

- US stocks and GDP have massively outperformed the rate of inflation.

Of course, if you didn’t earn a wage, invest, or own real assets then this is a big problem. Leaving your money under the mattress and never working is a bad strategy for protecting your wealth (and living!). But the lesson here is that a modest rate of inflation is not necessarily a bad thing.

This is something economists have known for a long time – you can have low-ish inflation and rising living standards at the same time (see here for more on this). This is why the Fed targets a low rate of inflation. We know absolute deflation and high inflation are both consistent with economic decline, or at least economic turbulence. And we also know that an economy can prosper with some very low level of inflation. Personally, I like to think of some low inflation as the cost of having a flexible currency and a social safety net. Capitalism is great at producing the things that make our lives great and some small amount of government intermixed can help capitalism from destroying itself thru inequality and corporate corruption. It doesn’t always work that way though and the USA has been one of the few long-time experiments where we seem to have found a good balance of capitalism and socialism. But the scales can and do tip.

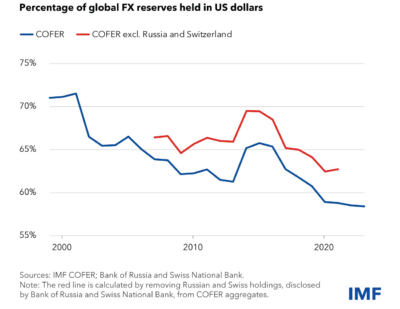

All that said, is there a real risk of the USD scale tipping? Of course. And you could argue it’s happening, albeit very slowly. For instance, here’s a chart of USD reserves held by foreign nations since 2000. The USD is losing its status as the dominant reserve currency, but it’s happening very slowly because the USD is the very best house in a neighborhood of bad fiat currencies (the next closest reserve currency is just 20% for the Euro and then 5% for the Yen – there’s no close competitor to knock off the USD). I think you can argue that no one does capitalism as well as the Americans and no one is more skeptical of socialism than the Americans. The combination results in the rare combination of a currency that is massively in demand (because its citizens and entities create things people want) and hard for its government to devalue (not that it hasn’t tried, especially in recent years). But all empires die and the US will not be an exception.

At the same time it’s unlikely that this is a material risk in the near future and even if it is there are simple ways to hedge that risk. The reason I say this isn’t a material risk is because America now stands as definitive evidence that capitalism works even if it’s a system that is the worst system, except for all the rest. Is there a shred of doubt that American corporations are the dominant players in the most important industries in the world today? And will that change any time soon? Who will topple the Apples, Amazons, Googles, NVIDAs, JPMs, WalMarts, Visas and Exxons? You can criticize Americans for lots of things, but innovating is not one of those things. And at the end of the day innovation is what drives currency demand because money is merely the tool we utilize to obtain the stuff. And despite a government that appears to be seemingly veering towards more socialist types of policies inflation has tended to remain stubbornly low, even after the Covid bump. And yes, inflation is now low today by historical standards (3% vs a 3.3% historical average) despite a few years of Covidflation.

If you think I am starting to sound naively optimistic about American capitalism and future inflation then don’t be confused. I am not ignorant of the potential risks and you could many make cogent arguments that countries like India, China or many others will outpace the USA in terms of innovation. And if you combined that with a rise in American socialism or unforeseen economic anomalies (like war, pandemics, etc) it’s possible that inflation could become more persistent and currency devaluation takes a turn for the worse. I wouldn’t peg that as my baseline outcome, but it would be naive to say it’s a zero probability outcome.

It’s also worth noting that a decline in reserve currency status need not be confused with hyperinflation. A hyperinflation tends to be a catastrophic decline in the currency generally due to wide-scale government corruption, losing.a war, collapse in production or other seismic geopolitical events. These are pretty rare and virtually unheard of in large developed economies, but still a risk. In my view the more likely “decline in the Dollar” will be a slow loss in global market share where the USA produces less of global GDP over time thereby resulting in declining need for foreign reserves. That scenario is hardly disastrous. Think of it as Wal-Mart going from the most valuable S&P 500 firm to the 10th. They’re no longer #1, but they’re hardly struggling.

But what if high inflation or even very high inflation becomes a problem that leads to a large loss in relative exchange rate value vs other currencies and assets? How does one protect against that potential outcome? Well, diversification, as we all know, is the answer. And what are the best inflation and currency devaluation hedges:

- Invest in yourself. The number one way to outpace inflation is to earn a high income by selling your skills to other people. The better your skills the more you’re likely to earn. Easier said than done, I know….

- Real assets. Things like real estate and gold come to mind. There’s a reason these are among the oldest and most trusted assets in human history.

- Stocks. Stocks are real assets at the end of the day because they are claims on the underlying real assets of the corporations that produce stuff. And stocks tend to perform exceedingly well in hyperinflation environments because the demand for their products rises relative to currency.

- Foreign denominated assets. If you’re worried about USD collapse you want to own things that are denominated in other currencies because the relative value of those assets will rise.

- Bitcoin. There’s now over a decade of evidence that cryptocurrencies and Bitcoin specifically can serve as a USD hedge. Personally, I tend to think the argument for BTC as a USD hedge is the least convincing, but if you’re a citizen of a developing nation I think the argument is extremely compelling. But even for Americans it’s a decent diversifier albeit in smaller values (because, as I’ve mentioned before it can be extremely volatile).

What percentage you decide to own of each is very personal and you don’’t need to be a hyperinflationist to make rational arguments for applying each of these to your life. If you’re a regular reader here you probably know that I like to match assets with liabilities based on a financial plan so that involves a very customized and personalized process. But as we all know from the Covid experience inflation is a very real risk and one that we should all consider when diversifying portfolios, even if we think the collapse of the USD is a low probability outcome.